THE HOSPITAL FUND ACT, 1930

The Hospital Fund Act Regulations

THE HOSPITAL FUND ACT, 1930

The Hospital Fund Act Regulations

Western Australia

The Hospital Fund Act Regulations

Contents

1.Commencement1

2.Short title1

3.Interpretation1

4.Definition1

5.Contributions to Fund, Section 42

6.Regulations “Land and Income Tax Assessment Act 1907,” Section 5. Contributions in respect of Income3

7.Notice to make Returns, Section 74

8.Contributions in respect of Income exempt from Taxation, Section 74

9.Return of Income, Section 74

10.Special Returns4

11.Contributors to take necessary steps for Lodgment of Returns5

12.Addresses of Contributors5

13.Returns to be signed by Contributor5

14.Instructions may be Endorsed6

15.Notice of Assessment under Section 56

16.Contributions in respect of Income, Section 56

17.Default Assessments, Section 67

18.Minimum Assessments — Method of Issue — Due date of Payment7

19.Postage to be Prepaid7

20.Copies of Returns7

21.Payment of Hospital Contributions8

22.Post Office to be Agent of Remitter8

23.Payment by Cheque9

24.Receipts to be Issued9

25.Part Payment not to be Accepted9

26.Insufficient Postage9

27.Contributions in respect of Salary and Wages9

28.Drawings by Principals and Partners not Liable10

29.Adhesive Stamps10

30.State Treasurer to issue Stamps10

31.Collection of Contributions from Casual Employees10

32.Cancellation of adhesive Stamps11

33.Fractional Contributions12

34.Stamping of Salary and Wages Sheets, Wages Books, etc.12

35.Application for Hospital Benefits, Section 1112

36.Proof of Contribution, Section 1213

37.Payments in respect of Contracts, Section 9, Subsection (3)13

38.Contributions by Companies, Section 814

39.Exemptions under “The Land and Income Tax Assessment Act 1907”15

40.Service of Notices17

41.Appointment of Prescribed Deputy17

42.Onus of Proof17

43.Spoiled Stamps18

44.Payment of Wages or Salaries in Lump Sums at various periods, Section 918

45.Payment of Allowances18

46.Proof that Patient is entitled to Benefit19

Schedule 1

Schedule 2

Schedule 3

Schedule 4

Schedule 5

Schedule 6

Schedule 7

Schedule 8

Notes

Compilation table29

Western Australia

THE HOSPITAL FUND ACT, 1930

The Hospital Fund Act Regulations

M.P.H. 1361/30; Ex. Co. No. 1215.

His Excellency the Administrator in Council has been pleased to make Regulations, as follows, under the provision of “The Hospital Fund Act 1930”.

F. J. HUELIN,

Under Secretary.

These Regulations will come into force on publication thereof in the Government Gazette.

These Regulations may be cited as The Hospital Fund Act Regulations.

These Regulations shall be construed with reference to the terms and interpretations of the Hospital Fund Act No. 39 of 1930, which Act is referred to hereunder as “the Act.”

In these Regulations —

“Commissioner” means the Commissioner of Taxation.

“Contract” means an agreement or mutual promise, written or verbal, upon lawful consideration or cause which binds the parties to a performance.

“Employer” means a person who employs clerks, workmen, or other persons working for salaries or wages or other remuneration.

“Old age and invalid pension” means an old age or invalid pension under “The Invalid and Old Age Pension Act 1908.”

“Payment” includes the value of a thing given other than money in discharge of a debt.

“Salary” and/or “wages” include all emoluments such as overtime, higher duties allowance, child endowment and district and other allowances, but not including travelling and motor car allowances.

5.Contributions to Fund, Section 4

Every person —

(a)In receipt of old age and invalid pension; or

(b)in receipt of pension granted for war service and paid by the Commonwealth Government, and not in receipt of income, salary, or wages equal to one pound a week or more; or

(c)in receipt of salary or wages under one pound a week, and having no other source of income; or

(d)whose income, including salary or wages (if any) is under fifty‑two pounds a year,

shall be exempt from liability to contribute to the Fund:

Provided, that pensions paid by the Commonwealth Government for war service shall include pensions paid on behalf of the Imperial Government or any British possession.

Provided also, that in assessing the amounts liable to Hospital contributions —

(i)pension granted for war service and paid by the Commonwealth Government shall not be taken into account; and

Value of Board and Lodgings, Section 4, prov. (ii).

(ii)board and lodging supplied by an employer for his employee in respect of wages not less than one pound a week shall be deemed to be equivalent to additional wages at the rate of one pound a week;

(iii)the board and lodgings also supplied to the employee’s wife and dependent children shall be assessed to the employee at the rates assessed under “The Land and Income Tax Assessment Act 1907 “;

(iv)board and lodging supplied by an employer and valued by him at less than one pound per week shall be taken into consideration at the value assessed by the employer;

(v)when board only is supplied by an employer it shall, for the purposes of the Act, be valued at 15s. per week, and when lodging only is supplied by the employer it shall be valued at 5s. per week.

Provided also, that a person in receipt of payments from a superannuation fund to which he has contributed, shall be exempt from liability to contribute to the Fund in respect of a proportionate part of each payment in ratio to the amount of his contribution.

[Regulation 5 amended by Gazette 5 December 1941 p.1747.]

6.Regulations “Land and Income Tax Assessment Act 1907,” Section 5. Contributions in respect of Income

The provisions of the Regulations under “The Land and Income Tax Assessment Act 1907,” and any amendment thereof, as in force immediately preceding the date of these Regulations relating to assessment and collection of income tax, shall apply to and in respect of the assessment and collection of contributions to the Fund.

7.Notice to make Returns, Section 7

Public notice shall be given in the Government Gazette annually of the time and place at which all persons liable to contribute to the Hospital Fund personally or in any representative capacity shall furnish returns for the purpose of assessment, and returns shall be in the Form of Schedule I. (Form H.F.A., No. 1)

8.Contributions in respect of Income exempt from Taxation, Section 7

If any contributor, other than a salary or wage earner, is not required to furnish an income tax return to the Commissioner of Taxation for the purpose of assessment under “The Land and Income Tax Assessment Act 1907,” of his income for the year ended the thirtieth day of June, 1930, or any subsequent year, on the ground that his income is of such amount, or is derived from such a source as to be exempt from income tax, or for any other reason, such contributor shall furnish a return of his income for 30th June, 1930, on Form H.F.A., No. 1, to the Commissioner of Taxation not later than the thirtieth of June, 1931, or for any subsequent year on or before the thirty‑first day of August.

A return of income by any contributor, except where the return has been lodged for the purpose of assessment under “The Land and Income Tax Assessment Act 1907,” shall be on the Form H.F.A., No. 1, in the Schedule, and shall be furnished at the time and place prescribed in the notice given in accordance with Regulations 7 and 8.

The Commissioner may at any time accept a return or notice in a form substantially similar to the prescribed form.

11.Contributors to take necessary steps for Lodgment of Returns

Whenever a contributor is required by the Act, the Regulations, or the Commissioner to furnish a return to the Commissioner, it shall be the duty of that contributor to make the required return, and to take all steps necessary to ensure that the return is received by the Commissioner at the place where under these Regulations the return is to be furnished.

(a)Every contributor shall, upon every return, give an address in Western Australia for service of Notice of Assessment, and shall from time to time give notice to the Commissioner of any change in his address within one calendar month after such change, and in default shall not be permitted to avail himself of the fact of such change of address in defence in any proceedings which may be instituted against him for any breach of the Act or Regulations.

(b)For the purpose of any notice under the Act or these Regulations, where not otherwise provided, the address given by any contributor in accordance with the Regulation shall be deemed to be his last known place of business or abode, as the case may be.

13.Returns to be signed by Contributor

Every return shall be signed by the contributor or by some person authorised by the contributor in that behalf, or, in the case of a company, by the public officer nominated under Section 45 of “The Land and Income Tax Assessment Act 1907.” If the contributor is unable to write his name his signature shall be made by a mark attested by a witness.

14.Instructions may be Endorsed

Such instructions and observations as the Commissioner may think fit may be endorsed or noted on any form of return, and reference to such instructions or observations may be inserted in the form or appended thereto.

15.Notice of Assessment under Section 5

The notice of assessment of hospital contributions shall be in the Form H.F.A., No. 3, in Schedule 2.

16.Contributions in respect of Income, Section 5

In cases in which an employed person returns income from investments or a business, or any other source except salary or wages, an assessment must be issued on such income separately. For the year ended the thirtieth day of June, 1931, the income liable for hospital contribution shall be one‑half of the net income as assessed under the “Land and Income Tax Assessment Act 1907.” The net income liable for Hospital Fund contribution shall be the income chargeable as assessed under the Land and Income Tax Assessment Act after adding thereto deductions allowed for — (a) general exemption; (b) repairs to dwelling‑house; (c) premium of life insurance or fidelity bond; (d) medical expenses; (e) travelling expenses (including Members of Parliament allowances); (f) children; (g) dependants; (h) capital expenditure on a mining tenement; or (i) gifts.

Adjustment of Contributions, Section 5

Provided that, in respect of the assessment and payment of contribution under the preceding paragraph the Commissioner shall, on receipt from the contributor of the return for the year ended the thirtieth day of June, 1931, reassess such contributor under the preceding paragraph; and, should such reassessment reveal an overpayment on the part of the contributor, such overpayment shall be credited against contributions due by him under this Act, for subsequent periods.

17.Default Assessments, Section 6

If an assessment is made by the Commissioner of Taxation under Section 43 of “The Land and Income Tax Assessment Act 1907 “ (assessment in case of default), contribution to the Fund in respect of the income of any person so assessed shall be due to the Department and payable to the Commissioner of Taxation on behalf of the Department, and Section 5 of the Act shall apply.

18.Minimum Assessments — Method of Issue — Due date of Payment

No assessment of less than one shilling shall issue, and no assessment under two shillings shall issue where the person is not assessed for State income tax. All assessments under the Act shall issue at the same time as assessments form income tax under “The Land and Income Tax Assessment Act 1907,” or dividend duty under “The Dividend Duties Act 1902.” All assessments under the Act shall be due and payable on the date shown on the notice of assessment.

Postage on every return, statement, communication, remittance, or other matter sent by post addressed to the Commissioner shall be fully prepaid by the sender.

A copy of or extract from a hospital contribution return of any contributor may, subject to the approval of the Commissioner, and upon payment of the prescribed fee (1s.), be supplied only to the contributor himself, or to some person authorised by the contributor in writing in that behalf.

21.Payment of Hospital Contributions

An employer may pay the hospital contribution, where deducted other than by means of adhesive stamps, in any of the following ways: —

(a)By delivery of cash, bank notes, or cheques to the commissioner, at the Taxation Department, G.P.O. Buildings, Forrest Place, Perth.

(b)By remitting the contributions to the Commissioner by bank draft or cheque, or postal money order or postal note, payable in the city to which the remittance is sent.

(c)By depositing the net amount of the contribution to the credit of the State Commissioner of Taxation at any branch of the Commonwealth Bank in Western Australia.

All contributions in respect of salaries and wages paid must be remitted to the Commissioner of Taxation within seven days of such payment, or within seven days of the end of each month in those cases where the Commissioner has approved of monthly remittances.

22.Post Office to be Agent of Remitter

When a remittance is posted by a contributor addressed to the state Commissioner, the Post Office shall be deemed to be the agent of the remitter, and payment shall not be deemed to have been made until the remittance has been received by the addressee. All remittances must be accompanied by a memorandum signed by the employer or his authorised agent, giving the period of payment of wages, number of contributors (employees), and total amount of wages paid, and upon which the contribution is levied.

When a cheque has been delivered or remitted to the Commissioner in payment of hospital contribution, the contribution shall (notwithstanding any receipt given therefor) not be deemed to have been paid until the amount of the cheque has been collected.

Receipts for hospital contribution shall be issued by such person as the Commissioner may authorise, and shall be in the form prescribed.

25.Part Payment not to be Accepted

Except with the express consent of the Commissioner, no money shall be accepted on account or in part payment of hospital contributions.

When any sum is received as payment of hospital contribution the Commissioner shall first deduct therefrom the amount of postage and surcharge (if any) paid upon any unstamped or insufficiently stamped matter received through the post from the contributor, and shall credit in payment of contribution only the net amount then remaining.

27.Contributions in respect of Salary and Wages

For the purpose of paragraph (c) (i) and (ii) of Section 9 of the Act, any person paying salary or wages may select the method of collection, either by means of adhesive stamps of the requisite value attached to the pay‑sheet or by deducting from the salary or wages payable by him contributions to the Fund and paying as prescribed to the Commissioner, and once the method of collection has been selected or adopted, no departure from the said method can be allowed without the express permission of the Commissioner.

28.Drawings by Principals and Partners not Liable

Drawings by the principal or partners in any business, either as salary or wages, or in anticipation of profits, shall not be liable for contribution under Section 9 of the Act, but will be assessed by the Commissioner under Section 5, in conjunction with the other income of the business.

The adhesive stamps to be used in connection with deductions of contributions to the Hospital Fund shall be of the form and size as prescribed in Schedule 3; such stamps shall only be printed by the Government Printer.

30.State Treasurer to issue Stamps

The State Under Treasurer for the time being shall be the only person authorised to control and issue on the part of the Minister Hospital Contribution stamps for sale to persons authorised to sell stamps by the Minister or the State Commissioner of Taxation.

All advances for stamps shall be properly recorded and shall be balanced monthly. A remittance of the value of the stamps sold shall accompany every application for fresh supply or recoup of the stamps sold.

31.Collection of Contributions from Casual Employees

Every employer of a casual employee shall see that payment of contribution is made by means of adhesive stamps of the requisite value to be affixed to a casual employee wages book where any payment amounts to fifteen shillings or over (inclusive of any remuneration by way of sustenance), and is either at a daily rate or in the nature of a contract.

Such wages book in the Form H.F.A./B., Schedule 4, will be supplied by the Department on the application of any casual employee, and non‑production thereof on the demand of an employer renders the employee liable to a penalty of Twenty pounds.

Alternatively to the affixing of adhesive stamps where any payment amounts to fifteen shillings or over (inclusive of any remuneration by way of sustenance), adhesive stamps of the requisite value of the aggregate of any casual labour during any one week may be attached at the termination thereof, and the last employer of the aggregate week shall be responsible for the affixing and the cancellation of the required stamps, for example, where an employee such as a gardener or charwoman is employed by several employers, and where the weekly or periodical payment for wages totals one pound per week or more, such employee shall keep a book, as prescribed, in which all payments for wages received shall be entered, and the employer making the last payment of wages in each week or period shall deduct the amount of the hospital contribution payable on the total weekly or periodical wages received, and shall attach a Hospital Contribution Fund stamp of the value of the total payments received, and shall cancel such stamp by initialing and dating the face thereof.

32.Cancellation of adhesive Stamps

All adhesive stamps attached to wages sheets, wages books, receipts, or other documents, and used in payment of contributions, shall be cancelled by the employer, employee, or paying officer by writing his name or initials and correct date of writing across the face of the stamps. Any person authorised by the Minister or the Commissioner may cancel stamps used in respect to the payment of hospital contributions.

Failure to cancel involves a penalty of Twenty pounds.

Overlapping of Stamps

When attaching adhesive stamps to wages sheets, wages books, receipts or other documents, they shall be so attached that one stamp does not overlap another for more than half the length of the stamp.

Where the contribution payable by a contributor amounts to 1½d., 4½d., 7½d., and so on, the employer or paying officer shall deduct the next highest penny in such cases, viz., 2d., 5d., 8d., and so on, and from the next following payment the employer shall deduct 1d., 4d., 7d., and so on, or subject to special arrangement, with approval of the Commissioner, the odd half‑pennies due in respect to any contribution may be deducted at the end of each month or quarter.

34.Stamping of Salary and Wages Sheets, Wages Books, etc.

Where two or more employees are engaged by an employer, and each employee is subject to a deduction from his salary or wage for a contribution, it shall not be necessary for the employer to attach to the salary or wages sheet, receipt, or salary or wages book signed by each employee a stamp for the amount of each employee’s contribution, but stamps to the aggregate value of the total contributions of all the employees may be attached to the salary or wages sheets, receipt, or salary or wages book (for example see Schedule 5).

35.Application for Hospital Benefits, Section 11

Where a contributor is subject to a deduction for contributions from his salary or wages by means of adhesive stamps, and is also liable for a further contribution to the amount of income from other resources for which he may be assessed by the Taxation Department, he shall, for the purpose of obtaining hospital benefit, make application on the Form H.F.A/C prescribed in Schedule 6.

36.Proof of Contribution, Section 12

Upon receipt of Form H.F.A/C., and subject to the correctness thereof, the Commissioner shall then issue a certificate in proof of the applicant’s contribution in the Form H.F.A./D. prescribed in Schedule 7.

37.Payments in respect of Contracts, Section 9, Subsection (3)

All payments in respect to any contract for work done or labour performed, including clearing, shearing, droving, and carting made by any person shall be deemed to be wages within the meaning of the Act. Every person making such payments shall deduct the amount of the hospital contribution due thereon, and shall pay the amount of such contribution to the Commissioner of Taxation in the manner prescribed, or he may purchase hospital contribution stamps to the value of such contribution and attach the stamps to the receipts, wages sheets, wages book, or other document in use, and shall cancel the stamps in the manner prescribed. In respect to contracts for shearing, the following deductions shall be allowed from each payment made by the employer or other person making such payments to: — Shearers, 2s. in the £; shed hands, 1s. 6d. in the £ (adults); shed hands, 2s. 6d. in the £ (18 to 21 years); shed hands, 2s. 6d. in the £ (under 18 years); pressers, 1s. 6d. in the £; cooks, 1s. 6d. in the £.

Where a lump sum is paid by a pastoralist, farmer, or any other person to a contractor who employs a number of shearers and other men in the shearing of sheep, and that contractor is unable to produce evidence from the Commissioner that he has furnished an income tax return, deductions must be made by the pastoralists, etc., but no deduction for expenses is to be allowed to the contractor beyond the deductions mentioned in the previous paragraph.

In respect to contracts for carting of super., wheat, oats, and other farm produce by a contractor using motor transport, a deduction of 50 per cent. of the contract payment shall be allowed to cover cost of transport, unless the contractor produces evidence from the Commissioner that he has furnished an income tax return, and in such case no deduction is necessary when payments are made to the contractor.

Hospital fund contributions must, however, be deducted by the Contractor when paying wages, etc., to any of his employees.

Any contractor claiming deduction for expenses beyond those covered by these Regulations, and allowable as a deduction from payments made, must make application to the Commissioner of Taxation at the time of furnishing his income tax return or a return of income under the Act.

In the case of contractors receiving progress and final payments on account of contracts who are also returners for income tax purposes under “The Land and Income Tax Assessment Act 1907,” or for hospital contributions under the Act, no deduction by means of adhesive stamps or otherwise shall be made therefrom on account of hospital contribution, conditionally that a certificate is given by the Commissioner to the effect that the contractor is a returner under “The Land and Income Tax Assessment Act 1907.”

38.Contributions by Companies, Section 8

Every company subject to “The Dividend Duties Act 1902,” and amendments thereto, shall, as and when every payment of duty under “The Dividend Duties Act 1902,” and amendments thereto, is payable to the Commissioner of Taxation, in addition to the duty payable under that Act, make a contribution to the Fund at the rate in the pound fixed by Parliament in respect to every pound of its profits as assessed under the Act.

In the case of a life assurance company, it shall be assessed at the rate in the pound fixed by Parliament on the amount of interest received from its investments.

Other insurance companies shall be assessed at the rate fixed by Parliament in respect of every three pounds two shillings and sixpence of the premiums received by the company after any allowance for reinsurances paid away.

Provided that the first contribution to the Fund shall be payable in respect of a proportionate part of the amount of the first assessment under “The Dividend Duties Act 1902,” and amendments thereto, after the commencement of the Act of the profits or income of every such contributor as shall bear the same ratio to the whole as the length of the period between the commencement of the Act and the first day of July, 1931, bears to a year:

Provided also, that income (in the nature of dividends) received by any person in respect of shares in any company that has duly contributed to the Fund shall be exempt from contribution to the Fund, but this exemption shall not apply to persons resident in Western Australia and receiving dividends from companies incorporated and carrying on business in the other States of the Commonwealth or from ex‑Australian companies. All such dividends are liable to contribution under the Act.

This section shall not apply to shipping companies.

39.Exemptions under “The Land and Income Tax Assessment Act 1907”

The following incomes, revenues, and funds exempt under the Land and Income Tax Assessment Act shall be exempt from contribution under this Act: —

(1)The revenue of municipal corporations, road boards, or other statutory public bodies;

(2)The incomes of life assurance companies and of companies or societies not carrying on business for purposes of profit or gain; but this exemption shall not apply to incomes derived from interest on investments;

(3)The dividends and profits of the Government Savings Bank and the Agricultural Bank;

(4)The funds and incomes of any registered friendly society or trade or industrial union;

(5)The incomes and revenues of all ecclesiastical, charitable, and educational institutions of a public character, whether supported wholly or partly, or not at all, by grants from the Consolidated Revenue Fund;

(6)The income derived or received by or on behalf of the Governor in respect of the salary and emoluments of his office;

(7)Any pension received by a person for injuries while on active service in the naval or military forces during the present war; or any pension paid to the widow, relatives, or dependants of a deceased soldier or sailor killed during the war, or who had died from injuries received, or sickness contracted, during the war, or any pensioner under “The Invalid and Old Age Pensions Act 1908 ”;

(8)The income of any society or association not carried on for the purposes of profit or gain to the individual members thereof established for the purpose of promoting the development of the agricultural, pastoral, horticultural, viticultural, stock‑raising, manufacturing, or industrial resources of Western Australia;

(9)The income of any society or association of a public character established for the promotion of scientific research;

(10)The cash allowances paid and the bonus shares allotted to shareholders of any co‑operative company or society as a rebate or discount on their trading with such companies or societies.

Any notice or other document, the service of which is not elsewhere provided for, shall be deemed to be served on the contributor by or on behalf of the Commissioner when service is effected —

(a)by delivering it to him personally;

(b)by leaving it at his address in accordance with Regulation 12 (a) and (b);

(c)by posting it in a letter addressed to him in accordance with the said Regulation 12 (a) and (b).

Any notice to be given by the Commissioner may be given by any officer of the Commissioner duly authorised in that behalf, and any notice purporting to be signed by the authority of the Commissioner shall be valid and effectual for all purposes as if signed by the Commissioner in person.

41.Appointment of Prescribed Deputy

The Governor may be notice published in the Government Gazette appoint any person to be a prescribed deputy of the Commissioner for the purposes of the Hospital Fund Act and these Regulations.

In any proceedings against the contributor for failing or neglecting to duly furnish a return, a certificate in writing signed by the Commissioner, or the prescribed deputy of the Commissioner, certifying that no return has been received from the contributor by any officer authorised by the Commissioner to receive returns at the place where under the Regulations the return should have been furnished, shall be prima facie evidence that the defendant failed or neglected to duly furnish a return.

If any stamp after having been issued in the manner prescribed in the Regulations shall have become damaged, spoiled, or unfit for use other than in the ordinary course of affixing to wages and salary sheets, the State Treasurer shall, upon application being made to him and upon delivery to him of the stamps damaged, spoiled or rendered unfit for use, cause a similar stamp or stamps of equal value to be delivered to the owner of such stamps so damaged or spoiled or rendered unfit for use, or to his representative.

44.Payment of Wages or Salaries in Lump Sums at various periods, Section 9

Where an employer (such as a pastoralist or farmer) makes payments of salaries or wages to his employees in lump sums at different periods the following provisions shall apply: —

(a)where a lump sum is paid to an employee after the 31st December, 1930, but covering a period prior to such date, no contribution is due on such payment;

(b)where a salary or wage is paid in a lump sum, or in instalments, and covers a period subsequent to the 31st December, 1930, a deduction shall be made by the employer of the amount of hospital contribution due on such payment; and

(c)where an employee is also entitled to receive his board and lodging, a sum shall be added to such payment calculated at the rate of one pound per week, dating from the first day of January, 1931, up to the date of such payment.

Retiring allowances, furlough, or any allowance for past services, when paid in a lump sum after the 31st December, 1930, shall be assessed for hospital contribution to the extent of 5 per cent. of the amount of the total allowance paid, but where such allowances, furlough, etc., are paid fortnightly or monthly after the 31st December, 1930, such periodical payments shall be subject to hospital contribution and must be deducted by the employer at the time of payment.

Note: Travelling allowances or any allowance granted to cover any special expenditure, except for living and maintenance, shall not be subject to hospital contributions under the Act.

46.Proof that Patient is entitled to Benefit

Every person claiming hospital benefit under Section 11 of the Act for himself or dependants, shall produce to the hospital authority evidence that he is a contributor to the Fund, and that his income for the twelve months preceding entry to hospital was less than £230, if married, and £156, if single, by —

(a)the production of a certificate from the Commissioner of Taxation or the Department;

(b)the production of a certificate, in the form of Schedule 8, from an employer, or paying officer, in cases where the contribution is collected pursuant to Section 9 of the Act;

(c)the production of a casual employee’s wages book;

(d)a statutory declaration that he is a contributor to the Fund, and stating the amount of his income for the twelve months preceding entry to hospital.

RETURN OF INCOME DERIVED FROM SMALL BUSINESSES AND OTHER SOURCES SHOWN BELOW DURING THE TWELVE MONTHS FROM 1ST JULY, 1930, TO 30TH JUNE, 1931

|

NOTE. —This Return must be made by every Person who has not furnished an Income Tax Return to the Taxation Department for the Year ended 30th June, 1931, and whose Income was £52 or over during above period. |

Taxation Office Stamp only. |

|

|

Surname |

Christian Name |

|

|

…………………………………….. |

……………………………………. |

|

Occupation ………………..…….Present Address ……………………………

Postal Address for service of Notices ……………………………………………

…………………………………………………………………………………….

|

Gross Income from Business of ………………………………… |

£………….. |

|

Less Gross Expenditure incurred in earning the Income but exclusive of all private and capital expenditure of any kind …… |

£ ………… |

|

Add — 1.Interest from Savings Bank Investments …………. |

£ …………. |

|

2.Interest from State Stock Bonds, Debentures, or other Securities …………………………………… |

£ …………. |

|

3.Pension from West Australian Government, British Government, or of any British Possession (but not including Old Age or Invalid, or a Pension paid for War Services) ……………………………………. |

£ …………. |

|

4.Other Income (give details) ………………………. |

£ ………… |

|

|

————— £………….. |

I,……………………………………., of ………………………………………

do hereby declare that the particulars shown above are true and correct in every particular, and disclose a true complete statement of all Income liable to taxation from all sources in Western Australia.

Sign here………………………………………..

(Usual Signature.)

Dated this…………………day of……………………193……..

(This Declaration must be signed by the Taxpayer personally.)

Form H.F.A. No. 3

Western Australia

HOSPITAL FUND ACT 1930

Notice of Assessment

|

File No. |

|

Please quote Account No.

Assessment No.

|

Take notice that I have, pursuant to the abovenamed Act, assessed you for Hospital Contribution as shown hereunder, on half your income for the twelve months ended 30th June, 1930.

I hereby require you to pay such Hospital Contribution on or before the …….. day of………………………..193…….

If the amount is not paid by the above‑named date it will be recoverable at law.

|

Income Chargeable or Profits |

Concessional Deductions |

Income |

Rate in The £ |

Contribution Payable |

||

|

£

|

£ |

£ |

|

£ |

s. |

d. |

|

Income liable to Contribution £ …………….. |

1½d. |

|

|

|

||

Note. — The Hospital Fund Act provides for the assessment to be based on the “Income Chargeable” as assessed under the Land and Income Tax Assessment Act, but without regard to the General Exemption, Concessional Deductions, and Interest on State Government Securities; or, in the case of Companies, upon the profits as assessed to duty under the Dividend Duties Act.

Commissioner of Taxation.

/ /193

[OVER..

The stamps to be used shall be in the form, and of the size appended: —

The denomination showing the respective value shall be placed in the centre shield.

Form H.F.A/B.

|

Date |

Name of |

Address |

Amount |

Stamp to |

Date |

Name of |

Address |

Amount |

Stamp to |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

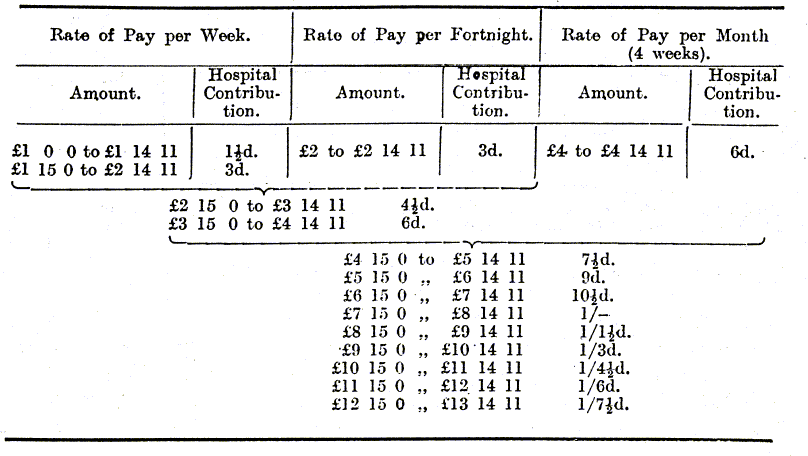

Schedule of Contributions payable by persons in receipt of Salary or Wages

Schedule of Contributions payable by Persons in receipt of Salary and/or Wages plus Board and Lodging valued by the Act at £1 per week

(Form H.F.A/C.)

Application for Hospital Benefits

To the Commissioner of Taxation, Perth.

I ….………………………………. (occupation)……………………………… of ………………………………….. having been a patient in the Public Hospital at ………………. From …………..……….. to …..……………….. hereby make application for a certificate under Section 12 of “The Hospital Fund Act 1930,” and declare that my gross income for the twelve months ended 30th June, 193 , amounted to the sum of ……………………………………

(amount to be written in words)

Particulars: —

|

Salary/Wages …………….. |

£ ………….. |

|

Other income (give details) |

£ ………….. |

|

Total Income …. |

£ ………….. |

The name of my employer during the above period was ………………………

Sign here…………………………………

(usual signature)

Dated this………………day of………………………….193…….

Form H.F.A/D.)

Certificate under Section 12 of “The Hospital Fund Act 1930.”

I …………………………………. Commissioner of Taxation for the State of Western Australia, hereby certify that ……………………………. Of ……………………… (occupation) is a contributor to the Hospital Fund for the year ended 30th June, 193 , has contributed an amount of £ ……………… and is a single/married person not in receipt of an income exceeding £156/£230 per annum* for the said year.

Dated this………………day of………………………….193…….

State Commissioner of Taxation.

*Strike out words or figures if inapplicable

THE HOSPITAL FUND ACT 1930

Certificate in support of Claim for Hospital Benefit

I hereby certify that ………………………………………………………………

(Here insert name of claimant for benefit.)

is employed by ……………………………………… at a wage of £……….per

(Insert name of employer.)

week (*together with Board and Lodging): that for the twelve months ended † ………………………….193……., I have paid him/her £…….. , and that contributions to the Hospital Fund by the said …………………………………..

(Name of Claimant.)

have been made whilst in such employment from ……………………………….

(Insert dates.)

to……………………………..

(Signed)……………………………………….

Signtaure of Employer or of Paying

Officer for Employer.

Address……………………………………….

Dated,……………………………………….

……………………………………….193……..

*Strike out words if inapplicable.† Insert date of admission.

1.This is a compilation of The Hospital Fund Act Regulations and includes the amendments referred to in the following Table.

|

Citation |

Gazettal |

Commencement |

|

The Hospital Fund Act Regulations |

17 Jul 1931 pp.1643‑53 |

17 Jul 1931 |

|

|

5 Dec 1941 p.1747 |

|

|

These regulations were repealed by the Hospital Fund Repeal Regulations 2005 r. 2 as at 1 Jun 2004 (see Gazette 1 Jun 2004 p. 1916) |

||